Personalized Financial Guidance to Help Build A Secure Future

Discover how we can help you build a tailored plan to navigate the tax, estate, investment, and retirement challenges ahead

HELPING TO SECURE YOUR FUTURE WITH GUIDANCE TAILORED FOR YOUR NEEDS

- Receiving professional advice to guide you

- Sleeping at night knowing you have a plan

- Making data-driven decisions

- Freeing up your time

Experienced

You've accomplished a lot in your career and you are ready to prepare for retirement.

Have Saved 500K+

You've saved and accumulated assets to meet your short-term and long-term goals.

Looking to Collaborate

You want someone to help you validate your plan and bring ideas that can help improve your situation.

Navigate your unique complex situation to achieve your financial future. Whether it's tailoring financial strategies to provide retirement income, optimize your retirement savings, being more tax efficient, or providing ongoing guidance to help maintain financial security post-retirement. We collaborate to guide you:

Pre-Retiree/Retiree

- You have saved and want to know if you have enough

- You may have investments/benefits from several organizations you need to coordinate

- You're concerned about turning your investments into income

Business Owner

- You are preparing to exit or retire from your business

- You want to understand the challenges ahead

- You may run a business that contracts with the government. (This is an expertise of ours)

You might not know what you need, where to begin, or how to handle your financial situation...

You might not know what you need, where to begin, or how to handle your financial situation...

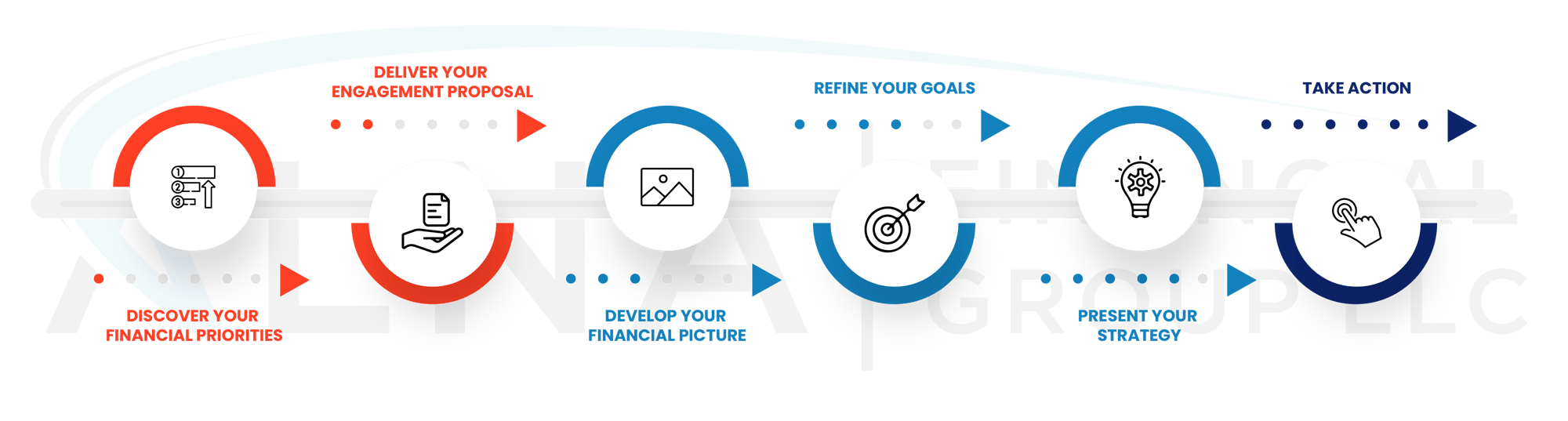

Our skilled team works with you to create a plan that prioritizes what matters most to you. Our Process:

- Data Gathering

- Vision, Values, and Goals

- Plan Presentation

- Implementation

- Review & Update

First

Gather the information needed to start planning

Data gathering is the important first step in our planning process. We work with you to uncover and understand your financial situation.

Second

Your unique vision, values, and goals drive our process and recommendations

- Your unique Vision, Values, and Goals

- Uncover potential opportunities and challenges

Third

Share your personalized plan to reach your goals

- Share observations, options, recommendations, and the action plan

- Work together to confirm priorities

Fourth

Implement your personalized financial plan

- Confirm your action plan

- Put your plan into action

Fifth

Review and Update Your Financial Plan

- Review and adjust your financial plan to match changes in your life.

Build A Plan for a Secure Future...

Financial Planning

Build a plan to help achieve your short and long-term goals.

Investment Management

Establish a disciplined, repeatable process for selecting and maintaining your investments.

Tax Planning

Take action to help minimize your income taxes now and in retirement.

Retirement Planning

Decide and manage the important decisions ahead concerning retirement savings, retirement income (Pension, Annuities, Social Security), and distributions (Required Minimum Distributions).

Risk Management

Help preserve and protect your wealth against unexpected death, disability/incapacity, or loss of income to create financial security.

Estate Planning

Prepare for the smooth, tax-efficient transfer of assets to the people and organizations you care about

Protect Your Wealth

Whether you're planning for retirement, safeguarding your family's financial well-being, or preserving your legacy, we're here to help.